city of richmond property tax bill

Search for Richmond Property Taxes. You can find your tax bill by entering either the Account No.

Paying Your Property Tax City Of Terrace

Mailings finished on June 15.

. 1 View Download Print and Pay Richmond VA City Property Tax Bills. How to read your Property Tax Bill See bill example to know How to Read Your Property Tax Bill. By Mail - Check or money order payable to.

To contact City of Richmond Customer Service please call 804-646-7000 or 3-1-1. Selecting options for consulting taxes. If you have difficulty in accessing any data you may contact our customer service group by calling 804 646-7000.

City of Jersey City Tax Collector. 815 am to 500 pm Monday to Friday. Get Record Information From 2022 About Any City Property.

Jack is sent a tax bill. The Tax Collector provide the necessary cash to fund City services with timely billing and collection of tax and sewer bills and auctioning delinquent tax sewer and miscellaneous charges during the annual Tax Sale. 280 Grove St Rm 101.

Broad Street Richmond VA 23219. Parking Tickets - T2 Systems. Manage all your bills get payment due date reminders and schedule automatic payments from a single app.

Real Estate and Personal Property Taxes Online Payment. Make sure you receive bills for all property that you own. Doxo is the simple protected way to pay your bills with a single account and accomplish your financial goals.

Richmond Va Property Tax Invoice Lookup. Richmond council agreed last week to move the property tax date to Sept. If you dont have your tax account number or property block lot information available for your online property tax payment.

210 Martin Luther King Jr Blvd Rm. City of Richmond Community Information Facebook Page. 295 with a minimum of 100.

804-333-3555 if you are missing any bills. Access City of Virginia Official Website. Allow 6 to 8 weeks for processing.

Jack cant pay that bill. Ad Unsure Of The Value Of Your Property. December 5 th-- Real Estate Personal Property Taxes.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. Contact the Treasurers Office at. 3 Road Richmond British Columbia V6Y 2C1 Hours.

For any questions about City of Plainfield taxes please contact the Tax Collectors Office at 908-753-3214. Collection of Taxes for Other Taxing Authorities. Monday - Friday 8am - 5pm.

Pay Your City of Richmond Bill with doxo and Protect your Financial Health. City of Richmond Tax Delinquent Sale. Personal Property Registration Form.

Demystifying Property Tax Apportionment httpstaxcolpcocontra-costacaustaxpaymentrev3summaryaccount_lookupjsp. Change the Name on Land Titles. City of Richmond 2019 and newer property taxes real estate and personal property are billed and collected by the Ray County Collector.

Electronic Check ACHEFT 095. Search by Parcel ID Parcel ID also known as Parcel Number or Map Reference Number used to indentify individual properties in the City of Richmond. Checking Account Debit - Download complete and send the automated clearing house ACH Payment Authorization Form to the above address or.

For commercial tenants wanting to change the mailing address of a utility bill contact the City of Richmond Tax Department at 604-276-4145 or TaxDeptrichmondca. Or the BlockLot Number and. Search by Property Address Search property based on street address.

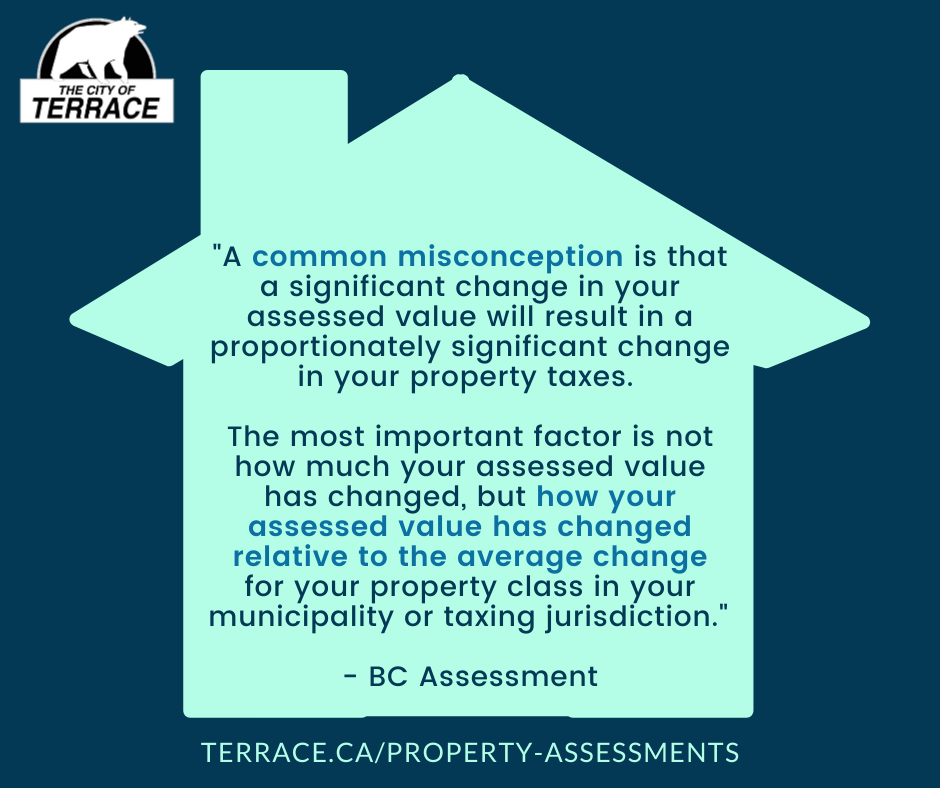

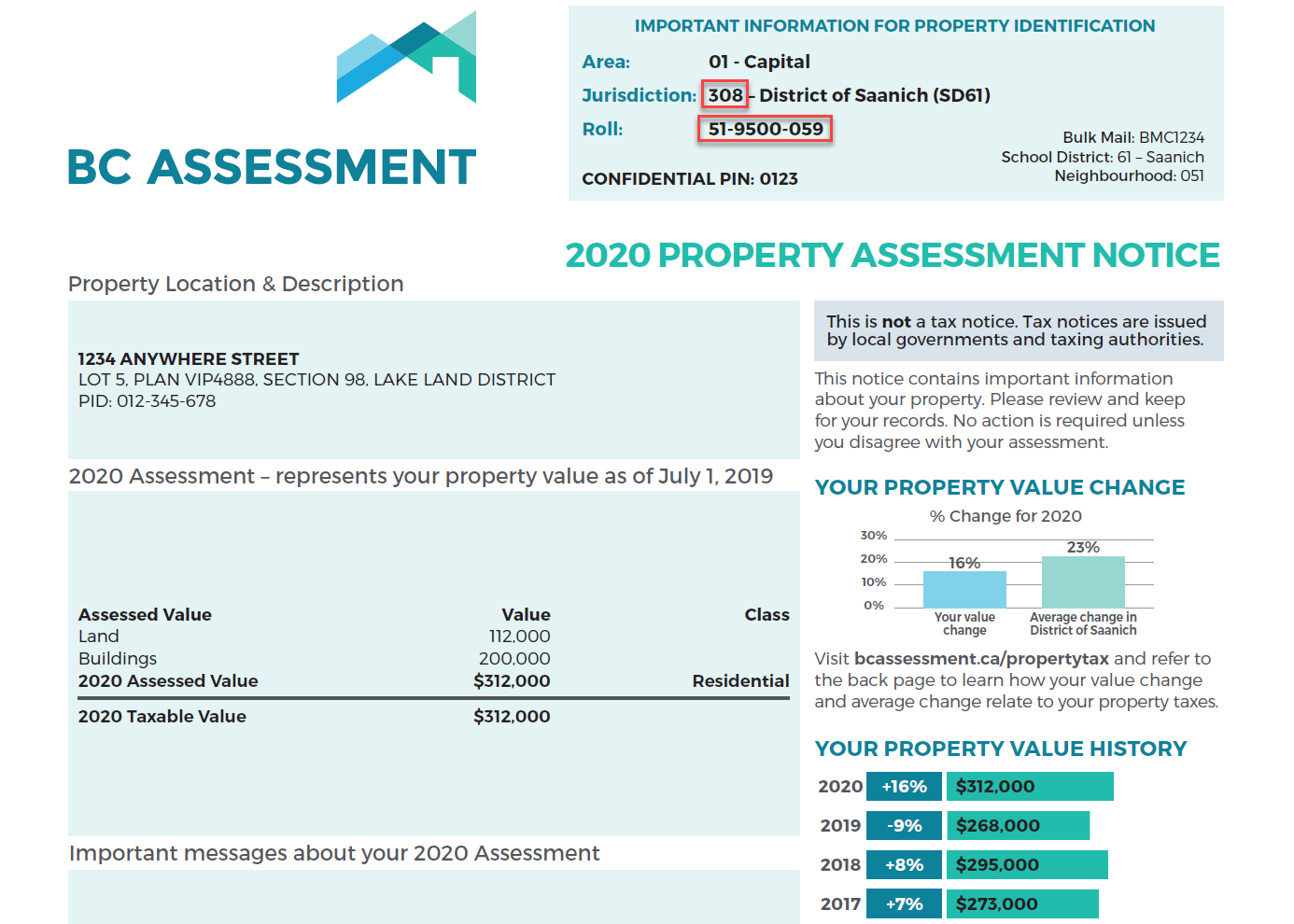

MERCK SHARP DOHME CORP. For more information contact BC Assessment at 1-866-825-8322 or wwwbcassessmentca. Business License - City of Richmond Instructions for Business License Online Payments.

Find All The Record Information You Need Here. 2022 final property tax bills were mailed by June 15. Taxes are due quarterly on February 1st May 1st August 1st and November 1st with a ten day grace period.

UNDER THE CODE OF VIRGINIA IT IS THE RESPONSIBILITY OF THE TAXPAYER TO OBTAIN ALL TAX BILLS AND TO MAKE TIMELY PAYMENT. Plus receive a detailed rundown of property characteristics ownership information liens title. Please enter an Account or Block Lot above or click magnifying glass button to search for parcel.

In Person - The Tax Collectors office is open 830 am. Ad Pay Your City of Richmond Bill with doxo Today. Richmond property taxes will be due on July 2 after all but no one will be penalized for non-payment until Sept.

Get a complete overview of all of the factors that determine your selected propertys tax bill with a full property report. Personal Property Taxes are billed once a year with a December 5 th due date. Pay your City of Richmond - Personal Property Taxes GA bill online with doxo Pay with a credit card debit card or direct from your bank account.

Municipal Property Assessment Mpac City Of Richmond Hill

All The Taxes You Ll Pay To New York When Buying A Home

15725 Kings Highway Montross Va 22520 Manufacturing For Sale Loopnet Com Montross Fenced In Yard Property Records

About Your Tax Bill City Of Richmond Hill

Where Do I Find My Folio Number And Access Code Myrichmond Help

Property Assessments City Of Mission

About Your Tax Bill City Of Richmond Hill

Homeowner S Guide To Ontario Taxes Property Tax Land Transfer Tax More

Toronto Property Taxes Explained Canadian Real Estate Wealth

Property Assessments City Of Terrace

Spreadsheets May Even Be Employed To Make Tournament Brackets The Spreadsheet Was Made By John Sterli Rental Property Management Investment Analysis Investing

Richmond Property Tax 2021 Calculator Rates Wowa Ca

Property Assessment Assessment Search Service Frequently Asked Questions

Toronto Property Taxes Explained Canadian Real Estate Wealth

:format(webp)/https://www.thestar.com/content/dam/thestar/business/personal_finance/2010/09/07/property_tax_10_things_you_need_to_know/the_take_on_the_taxhike.jpeg)

Property Tax 10 Things You Need To Know The Star

About Your Tax Bill City Of Richmond Hill

Notice Of Rent Increase Form Letter Templates Letter Templates Letter Form Being A Landlord