monterey county property tax due dates 2021

1055 Monterey Street Room D-120. The Trustees Office is responsible for managing over 211 million per year for all county finances.

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Learn all about Monterey real estate tax.

. Overall countywide property tax collections for the 2021 tax year are 66 billion an increase of 256 million from the previous year of 63 billion. 15 Period for filing claims for Senior Citizens Tax Assistance. This due date is set by the Assessor and may vary.

Discover Calif Property Taxes Due Dates for getting more useful information about real estate apartment mortgages near you. The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300. New monthly reporting forms for the reporting period beginning in January 2021 are available below.

Property taxes are due on the third Monday in August. We normally expect to receive payments electronically 1-2 days before the April 11 deadline even if your mortgage company tells you or your statement shows it was sent earlier. May 7 Last Day to file business property statement without penalty July 1 Start of the Countys fiscal year.

Hpap Program In Washington Dc Omni Hotel Washington Dc Map Eleven Parkside Apartments Washington Dc. Only current year taxes may be paid by phone. The 2018 United States Supreme Court decision in.

Ad Find Monterey County Online Property Taxes Info From 2021. Any property owner with questions about their property tax bill should contact the Tax Collectors Office at 831-755-5057 or taxcollectorcomonterey. Find Information On Any Monterey County Property.

You will need your 12-digit ASMT number found on your tax bill to make payments by phone. Salinas or checks can be dropped off at the City Finance Offices in Carmel Seaside and King City. A 10 penalty is added if not paid before 500 pm January 1.

If the delinquency date falls on a Saturday Sunday or legal holiday the hour of delinquency is extended to 500 pm. The Trustee acts as the countys banker and also collects county taxes. Friday December 10 2021 Be sure to mail your tax payments postmarked by the United States Post Office on or before the December 10 2021 delinquent date in order to avoid a 10 penalty.

Participate Get Involved. First installment of secured property taxes payment deadline. April 10 Last day to pay 2nd installment of property taxes without penalty.

Monterey County Superior Court. The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and innovative services in the collection of property taxes. Monterey County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections.

For assistance in locating your ASMT number contact our office at 831 755-5057. Monthly reporting will be effective beginning with the month of July 2020. This is the total of state and county sales tax rates.

April 10 Last day to pay Second Installment without penalties. 1-831-755-5057 - Monterey County Tax Collectors main telephone number. Property taxes are levied on property as it exists on January 1st at 1201 am.

July Tax bills are mailed and due upon receipt. Unsecured taxes must be paid on or before August 31st unless otherwise stated. The Monterey County sales tax rate is.

Monterey County has one of the highest median property taxes in the United States and is ranked 178th of the 3143 counties in order of median property taxes. Payments may also be made in person at the county tax collectors office 168 W Alisal St. SB 272 Enterprise Systems Catalog.

See note February 1 - Second installment due Secured Property Tax April 10 - Second installment payment deadline. Monterey County collects on average 051 of a propertys assessed fair market value as property tax. The following business day.

June 30 Last day to pay current years taxes without additional penalties. Due November 1st Delinquent after 500 pm. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of 051 of property value.

November 1 - First installment is due Secured Property Tax and delinquent Unsecured accounts are charged additional penalties of 1½ until paid. The VAF Return Form must be mailed to or filed at the City of Monterey Finance Department accompanied by remittance for. New monthly reporting forms for the reporting period beginning in January 2021 are available below.

Payments can also be made by telephone. Tax bills are generated every fiscal year July 1 through June 30 and mailed in mid-July. Please contact the Tax Collector at email protected or at 805 781-5831 if you have questions about your tax bill.

Total County property value increased by 265 from 6425 billion to 6595 billion between 2020 and 2021. PROPERTY TAX DUE DATE The deadline for payment of the first installment of 2021-2022 Monterey County Property Tax is. Affects the upcoming fiscal year January 31.

VAF Returns and payment will be due on the 15th day of the following month. The second installment of the 202122 Annual Secured Property Tax Bill is due February 1st and will become delinquent if not paid on or before April 11th. 2021-22 SECURED PROPERTY TAX BILLS The last timely payment date for the second installment is April 11 2022 IMPORTANT INFORMATION FOR MORTGAGE COMPANY PAYMENTS.

The minimum combined 2022 sales tax rate for Monterey County California is. The California state sales tax rate is currently. First installment of secured property taxes is due and payable.

First Installment is due. 2021 Property Tax Calendar. December 10 - First installment payment deadline.

December 10 Last day to pay First Installment without penalties. The Trustee deposits collected taxes into secure investments until they are distributed to all county offices for their budgets as set by the county commission. Choose Option 3 to pay taxes.

February 1 Second Installment is due. July 1 Oct. 1-831-755-5057 - Monterey County Tax Collectors main telephone number.

2nd Installment - Due February 1st Delinquent after 500 pm. July 2 Nov. Whether you are already a resident or just considering moving to Monterey to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

The Trustees Office has no control of the amount. Transient Occupancy Tax TOT delinquency deadline if not paid before 500 pm. A 10 penalty is added as of 5 pm.

The Monterey County sales tax rate is.

Secured Property Taxes Tax Collector

Melinda Gunther On Twitter Real Estate Infographic Real Estate Trends Rent Vs Buy

El Camino De Mar Seacliff San Francisco Caiifornia House Styles Architecture Estates

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

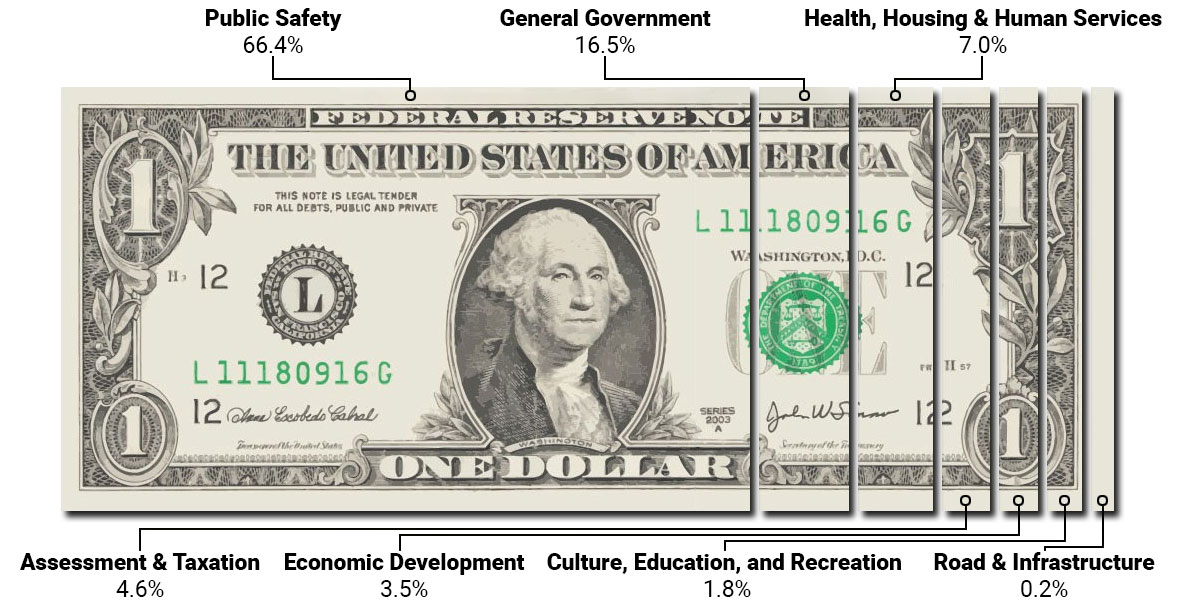

Assessment And Taxation Clackamas County

California Localities Extend Tax Relief To Marijuana Companies In Absence Of State Action

Payment Options Monterey County Ca

Contact Us Treasurer And Tax Collector

Pebble Beach A 779 Newly Remodeled Near Spanish Bay In Pebble Beach Renting A House Beautiful Backyards Pebble Beach

How To Find Tax Delinquent Properties In Your Area Rethority

Pickett County Tennessee 1888 Map Tennessee Map Tennessee County Map

See The Direction To 5 Acres Yucca Valley Property In San Bernardino Ca In 2021 Riverside County San Bernardino County Desert Hot Springs

Second Installment Payments For 2019 20 Secured Property Tax Bills Are Due February 1st County Of San Luis Obispo